We may earn money or products from the companies mentioned in this post. This means if you click on the link and purchase the item, I will receive a small commission at no extra cost to you ... you're just helping re-supply our family's travel fund.

As we approach the New Year, I’ve asked my friends to submit their personal finance stories. The challenge I posed? To pay off debt quickly. As a former financial advisor, I’m passionate about living well on a budget.

Throughout the rest of 2018 and 2019, we’ll be following the story of Terri*. Terri is a good friend of mine and fellow Midwest blogger. She’s harboring a deep secret, and for that reason we’ve kept her *anonymous: she’s in debt in the many six figures. Not only that, but she’s often overdrawn in her account. This makes any financial emergencies detrimental to their livelihood. She’s had enough and is putting together a plan to pay off debt quickly. It starts with taking a real, hard look at the debt. Leave no stone unturned!

Who is Terri?

Terri was born and raised in the Midwest alongside her husband and three children. They bought a home three years ago and drive a newer SUV that’s almost paid off. On the surface, things don’t seem too bad. She’s educated and the breadwinner of her family.

Yet, her education cost her: she has a lot of student loans. Despite having a corporate job and a blogging career, it’s not enough to pay her student loans. She’s on income-based repayment and her payment is zero as a result.

She also has maxed out each of her credit cards, and does so every single month.

Let’s break down her debt

Student Loans: $183,254.93 including interest of $9,077.29 with an average interest rate of 6.26%

House: $102,367.18 with an interest rate of 4.5%. She will need to refinance her home or pay a balloon payment of $93,929.91 in December 2023. Her monthly house payment is $524.93** that she splits into two bi-weekly payments of $263. These come out of her paycheck before it ever hits her account.

SUV: $2,970.15 on her SUV and pays $126 bi-weekly before her paycheck hits her account. Her interest rate is 6.99%.

Personal Loan: $4,210.52 with an interest rate of 32%, pay off date is July 15, 2022

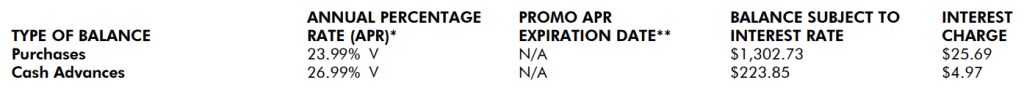

Discover Credit Card: $1,495.78, credit line $1500, leaving $4.22 available. Minimum payment: $51/mo, interest rate:

Barclay Credit Card: $2,067.21, credit line $2,000, over the limit by $67.21. Minimum payment: $70/mo, interest rate:

Capital One Credit Card: $3,616.07, credit line of $3,500, over the limit by $116.07. Minimum payment: $113/mo, interest rate:

Paypal Credit: $1,334.69, credit line of $1,347, leaving $12.31 available. Minimum payment $80/month, but often defaults. Interest rate of $25.99%, but does not report to credit bureaus.

Lawyer: $2,331.47 outstanding, paying $100 bi-weekly through billpay from checking account.

**These do not include her property taxes or homeowner’s insurance. She pays her homeowner’s insurance yearly, and property taxes semi-annually. This comes out to around $221/month.

Business Debt

Business Credit Card: $10,185.22, credit line of $10,000, over the limit by $185.22. Minimum payment: $300/mo, interest rate of 22.99%

Mentor #1: $1,875 outstanding, three monthly payments left of $625 each. No interest charged.

Mentor #2: $700 outstanding, two monthly payments left of $350 each. No interest charged.

Mentor #3: $1,000 outstanding, not making payments but needs to. No interest charged.

Facility Rent for Business: $1,875 outstanding, not making payment but needs to.

Collections

AMEX Business Card: Defaulted this year and owes $3,176.46. This is a priority for her to payoff as it shows on her personal credit report now.

Medical Debt: $1162.99 to various providers for many different service dates.

Personal: Needs to dispute about $1,000 to DirecTV for equipment never used. Debating whether she should do this or just wait the 7 years to run out for it to drop off collections as it’s almost here.

Account Balances

Checking: $131.48

Paypal: $102.71

Where she went wrong

1. Attending college, she took living expense checks to cover expenses. While nice then, it’s now compounding incredible amounts of interest. She also went to an expensive University.

2. Maxing out her credit cards and going over the limit each month.

3. From January 1 to October 31st, she’s had $1,631 in fees between returned check fees and overdraft fees. These fees are $28/each – making it shy of six of these per month.

4. Not setting a budget

5. She never balances a checkbook

6. She doesn’t read her mail much. The debt and bills have become overwhelming so she often doesn’t open bills.

Terri’s Plan to Pay Off Debt Quickly

1. Stop mindless spending – like runs to the gas station for snacks, pop, and energy drinks. A small leak can sink a great ship.

2. Use YNAB to do a zero-based budget in addition to using actual envelopes for daily spending. The envelopes will help her curb her mindless spending. YNAB will help her see where her money is going and allow her to get on track fast. This is the same program I use and I love it. Use my referral link to get a free month.

3. Pay off the remaining three payments to her mentor to free up $625 in her budget to throw at debt.

4. Pay off $1,875 in facility rent because this has a very high chance of getting sent to collections any day now. Or worse, getting sued by the facility.

5. Pay off $3176.46 to the debt collector for AMEX as this is very likely to result in small claims court soon.

6. Have an emergency fund of $1,000.

In December, we’ll break down Terri’s YNAB budget so we can see all her monthly expenses in addition to debt. We’ll compare this to her income.

If you’re in a similar situation, there is hope! This hope doesn’t involve filing for bankruptcy! While you work on your own budget and debt, check out my 10 brilliant ideas for making money online (no, these strategies don’t include $5 surveys, either!).

If you loved this blog post, please share on Pinterest:

Leave a Reply